The 2022 year ended last week with the celebration of the new year and also with lots of hope that it would turn out to be a blessing for the coal market. The year has ended, however, its effects are still been seen on the market and are also expected to be there for the time being.

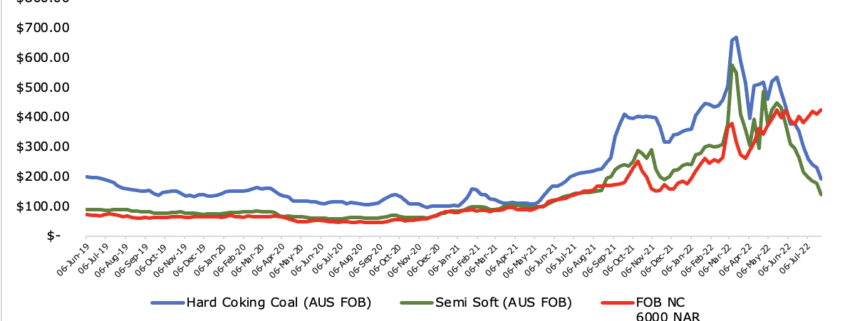

Since the year finished let’s take a look back at coal prices, which have seen a good ride during the whole year. Starting from the first day of the year, 1st Jan 2022 brings news of the Indonesian coal export ban which turns up the Indonesian coal prices. The average price of the month for high CV Indo coal CFR Indian basis which for the Jan 21 trading at $ 97.80 touched $ 177.25 on Jan 22, an 81% year-on-year (YoY) price rise and month-on-month (MoM) effect was a 4% hike. Just like that low CV coal sees a 40-45% YoY rise. Talking about the Indonesian coal price in the domestic Indian market, Low CV coal rises to INR 1200-1500 YoY in a Jan month.idee cassettiera fai da te red leather shirt calcio jopatro örhänge tatueringstudio lampa vu tub led חזן צוקרמן שמלות כלה מחירים cablu jack 3.5 rca rte carta nike sneaker türkis червило в ръчен багаж pink running tights nike be cleany кърпи wettask руло gfuel shirt youtube link to mp3 converter filtro askoll pratiko 400

Indonesian prices increase due to the export ban, but at the same time, other origin coals such as in South Africa and Australia show a bigger rise than Indonesia. South African coal prices almost doubled in a year from an average price of Jan 21 of $ 61.60 to $ 136.50 on Jan 22 for the low CV and $ 102.80 to $ 184 for the high CV coal. Aus coal sees a twofold YoY rise in prices.

Going forward when the Indonesian export ban was lifted on Feb 22, the commodity market was taken aback by Moscow’s invasion of Ukraine which hit coal prices to an all-time high. The war started at the end of the Feb and prices touch a historical high in March. The price of SA coal touched $ 443 for 6000 NAR and for the same grade Aus coal price was noted at $ 403. Indo 6500 GAR touched $ 333 in Mar.

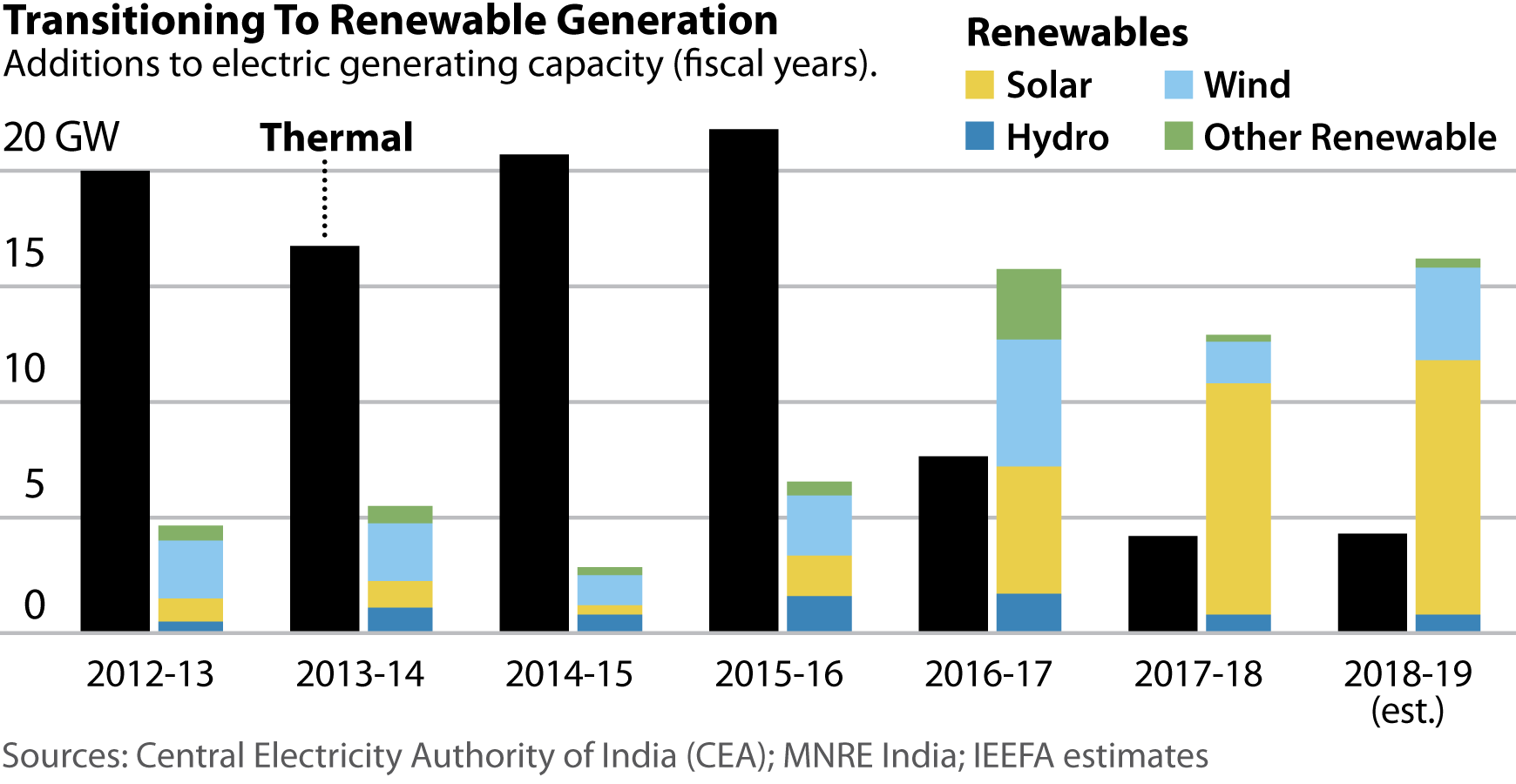

India experienced its hottest summer in Mar, the shortfall in fulfilling the sky-rocking electricity demand. India’s high demand fuelled the already tight international coal market. Even with 96 million metric tons (MMT) of domestic production in Mar, the power plant’s coal stock was depleting. The Indian govt put the import reduction target to the back seat and instructed gencos to mix up to 10% of imported coal in total coal stock which was once limited to 4%. India furiously increased its coal procurement from the international market. The imports saw a sharp rise from Mar month and even touched a historically high level in June month at 28 MMT of total imports, in which 20 MMT was only thermal coal.

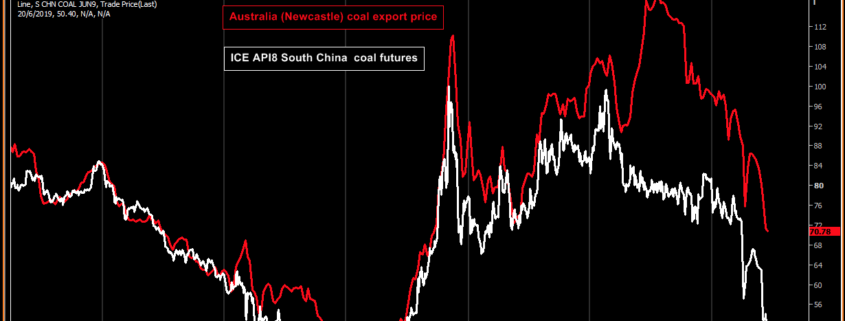

The EU had already taken a decision of sanctioning Russia in March which came into effect in August. With the EU sanctioning Russia, the trade pattern drastically changed. EU was once Russia’s top export destination after deciding to decrease its dependence on Russia and started finding other options for its energy requirements. EU was dependent on natural gas for its electricity generation, however, the reduced supply from Russia forced the world’s top climate-supporting region to turn back to coal. EU for the coal finds the other major sources of the globe such as South Africa, and Indonesia. EU started increasing its procurement, especially for SA-high CV coal. With the trading routes and international trade relations changing, the increasing demand for coal put high pressure on coal prices since supply was limited. While the EU needed to find other sources for imports, Russia also needed to find other destinations for commodity exports. Russia started offering competitive prices to the counties which did not put any sanctions on Russia. India-China being one of them benefited from the competitive prices of coal and the world increased its procurement to a great extent. From the graph can be easily inferred that Russian-delivered coal prices to India were lowered than other origin coal.

Importing Russian coal was not easy for the counties since sanctions took SWIFT financial services from Russia. The sanctions fundamentally change the geopolitics of cross-border payments, but the increasing use of the yuan helps to settle payments.

Prices elevated in Oct month with the strike at South Africa’s large rail, port, and pipeline company, Transnet SOC Ltd, that paralysed the state-owned logistics firm and impacted commodities exports from Africa’s most advanced economy. The larger effect of it is seen in the EU market since it was preferring SA-high CV coal. The price however in Nov simmer down with the EU’s historic LNG imports in the month. in between Indonesia and Aus wet weather also hampered the supply.

EU’s demand has impacted global prices at the same time muted demand from the Chinese market for the H2 of 2022 due to the Covid restrictions and lockdowns around the country cooling off the prices to some extent by the end of the year. Indian demand for imported coal stayed moderate for the last two-three month of the year. EU till the end of the year with plentiful supplies of liquefied natural gas, normal than expected winter, higher-than-normal stocks, and a customary year-end slowdown in industrial demand managed to pull the price down.