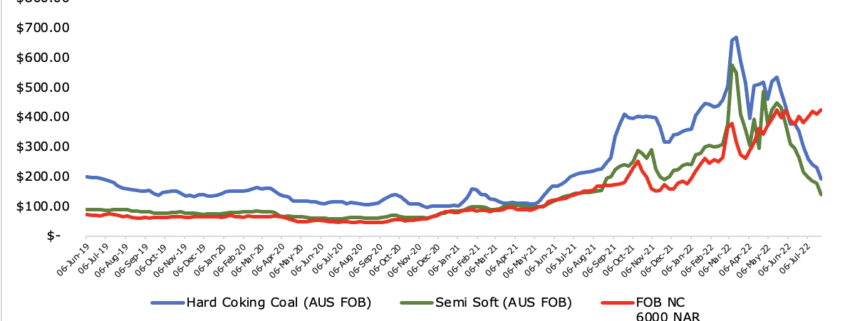

The Australian coking coal (HCC and semi soft) and thermal coal(6000 NAR) prices which were almost showing a similar pattern of positive correlation over the years are now showing negative relation. The pattern was simple both coking and non-coking coal prices increase or decrease simultaneously. Whereas, from the mid-April of 2022, both coal prices have started experiencing opposite pattern, where coking coal prices have been contracting and on the other hand non-coking coal prices are heading north. For years, the prices of coking coal were higher than non-coking, but that is changed and now non-coking coal prices are much higher than its counterpart.

Thermal coal prices are on top as electricity demand is increasing globally, especially in China and India and the supply side shortages occurred because of Russia’s invasion on Ukraine. Europe increases its demand for coal and restarts the coal-fired power facilities as a backup plan to offset the decline in Russian gas supplies.

On contradictory the coking coal prices are reducing because of the low demand from the steel industry and as production remains more or less the same, supply is strong. Figures from worldsteel show that global crude steel output came to 158.1 million tonnes in June – down 5.9% compared with the same month in 2021. The restrictions associated with tackling Covid-19 severely affected the Chinese economy in the first half of 2022. Steelmaking in that period declined by 6.5%, year-on-year, to 526.9 million tonnes. Except for India all the other top ten steel producing nations in world have experience a decline in steel production. The demand for coking coal largely came from the steel industry, coking coal prices have reduced with the reduction in steel output.

Leave a Reply

Want to join the discussion?Feel free to contribute!