If API2 coal prices remain low for the next several months, there may be a ripple effect across the U.S. thermal coal space as the industry grows increasingly reliant on exports and domestic demand declines, analysts said. The API2 benchmark tracks the price of thermal coal sold into Europe.

Several U.S. coal producers benefited from strong international pricing in 2018, but many observers are predicting exports will decline this year as well as in 2020. Various factors may contribute to that decrease, including lessened demand in Europe, competition from Russia and political issues between nations, but analysts said lower prices will also make it less economically feasible for domestic producers to sell abroad.

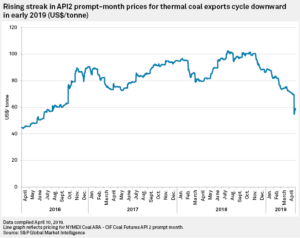

API2 prompt-month prices for thermal coal have trended more positively overall since April 2016, even exceeding $100/t several times during 2018, according to data compiled by S&P Global Market Intelligence. Since late October 2018, API2 prompt-month prices have dropped considerably, falling below $70/t at the end of March and below $60/t during the first week of April.

Coal producers have locked in much of their 2019 sales already, but the current low pricing environment could start to affect pricing in the second half of 2019 and likely more significantly in 2020 if prices remain low through the summer or into the fall, several analysts said. U.S. thermal producers generally need prices anywhere from $70/t to $80/t to compete internationally.

Gregory Marmon, a senior research analyst at Wood Mackenzie, expects coal prices will remain below $80/t through the rest of 2019, causing exports to fall year over year from 2018 levels.

“They’re going up from today’s lows,” Marmon told Market Intelligence, “but they’re not going to hit the point where … the average coal mine in the U.S. is going to be profitable.”

Impact on domestic sector

With fewer tons being sold abroad, coal companies may shift that thermal coal back to the domestic market, which could put downward pressure on steam coal pricing, especially in the Illinois Basin and Northern Appalachia, Seaport Global Securities LLC analysts Mark Levin and Nathan Martin wrote in an April 8 report. That shift could even potentially hurt lower-grade metallurgical coal pricing.

Benjamin Nelson, Moody’s lead coal analyst, said the U.S. coal sector has grown increasingly dependent on exports. The sector has historically been a swing supplier in the global market because of its distance from international customers and costs, he said, but export volumes have increased significantly the last few years, even outrunning the declining domestic thermal demand more recently. That shift has helped “firm up prices domestically.”

“If there was a meaningful pullback in export volumes, that would create pressure on the domestic market,” Nelson told Market Intelligence, adding that, given the current pricing environment, “I think we’re getting to the point where we may start to feel that a little bit.”

But the industry does not always see an immediate impact of a short-term price movement, he said. If prices stay low or drop further, the industry will discuss those challenges throughout 2019.

“If you look forward to a coal industry that’s much more heavily reliant on exports, given where the U.S. producers are in terms of cost structure, that could cause the coal industry to become more volatile,” Nelson said. “But, again, there’s a lot of other forces that are at play here …. so it’s really hard to make definitive, long-term calls on something like volatility because exports are increasing.”

Clarksons Platou Securities analyst Jeremy Sussman said the larger exporters are “fairly insulated” from low pricing in the second half of the year, while smaller companies may be more affected. Low prices over the next three or four months will begin affecting early 2020 sales.

“We can live with Q2 being weak. It’s going to be harder to live with Q3 being weak,” Sussman told Market Intelligence, adding that, “if API2 pricing stays where it’s at, then domestic pricing is not going to be immune to the downturn.”

Levin and Martin estimated that thermal coal exports accounted for 38% of Foresight Energy LP 2018 shipments, 26% of Consol Energy Inc.’s and 25% of Alliance Resource Partners LP’s, making them the most exposed to export steam fluctuations. But the Powder River Basin, which some experts say is already oversupplied, may be hit the hardest if more tons are sold on the domestic thermal market, Sussman said. This situation could be worsened if export prices remain low and some of the larger Illinois Basin producers follow through on plans to increase production this year.

“While I would say the Illinois Basin would be the most directly negatively affected region from this, the reality is if you combine more domestic Illinois Basin coal with an already fragile PRB market, this doesn’t bode well for the PRB,” Sussman said.

But Marmon noted low utility stockpile levels, which may help make room for excess Illinois Basin coal being shifted to that market. The domestic market may help counterbalance some lost opportunities abroad.

Moody’s: Price drop will not have major effect on credit

From a credit perspective, some coal companies are generating “significant excess cash flow” and investing in share repurchases, Nelson said. Given their current financial situation and contracts, a modest drop in export volumes and compression in domestic prices “doesn’t create a big credit concern across the industry, broadly speaking.”

Companies may repurchase fewer shares if they see a decrease in cash flow from exports, he noted, but that would have more of an impact on the producers’ equity price rather than their credit quality.

“We don’t have many producers that are making significant investments in new capacity for exports,” Nelson said. “There’s been a couple projects discussed, but it’s not like we’re in the middle of a big capital wave and now we’re starting to see prices come off.”

Source: spglobal.com

Leave a Reply

Want to join the discussion?Feel free to contribute!